All Categories

Featured

Table of Contents

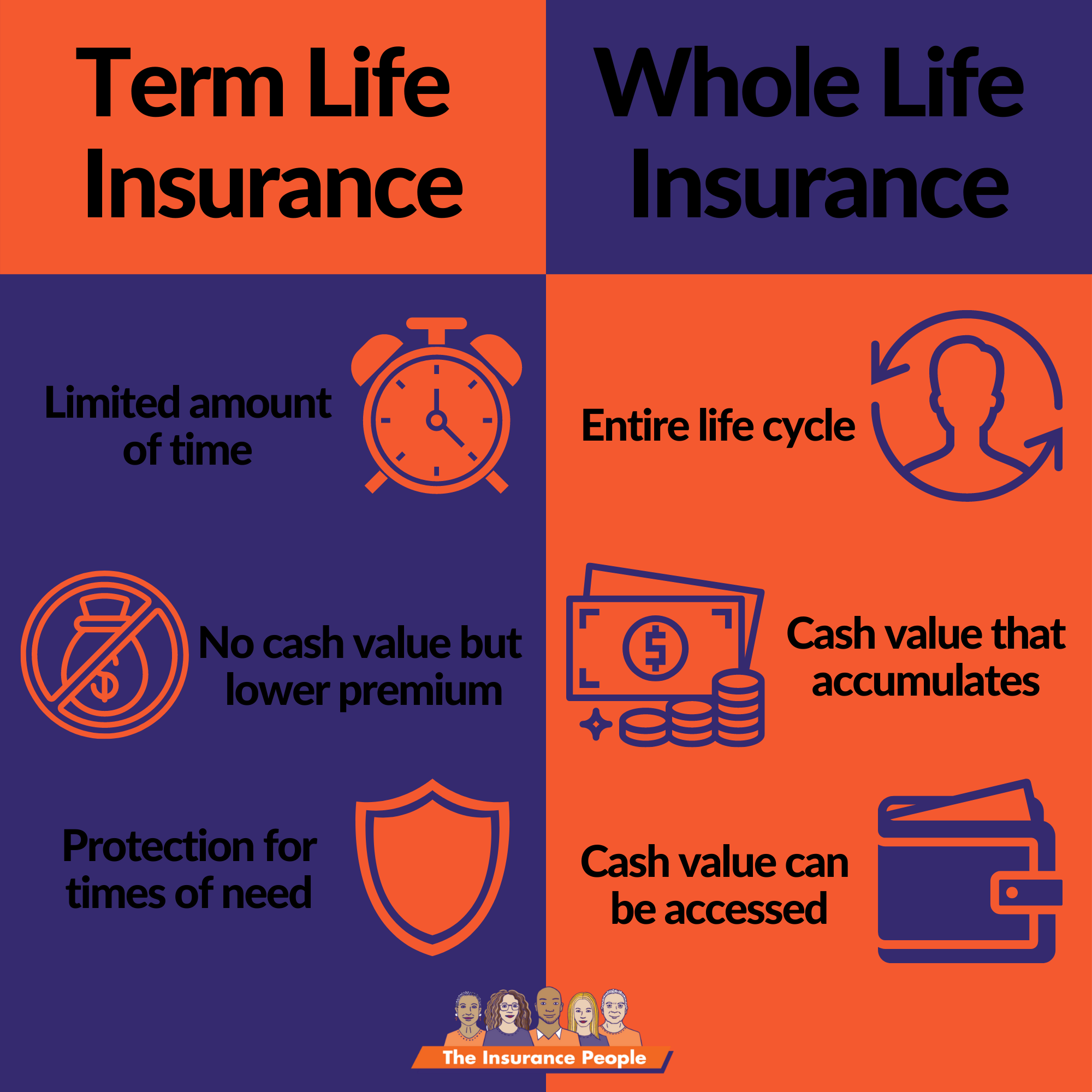

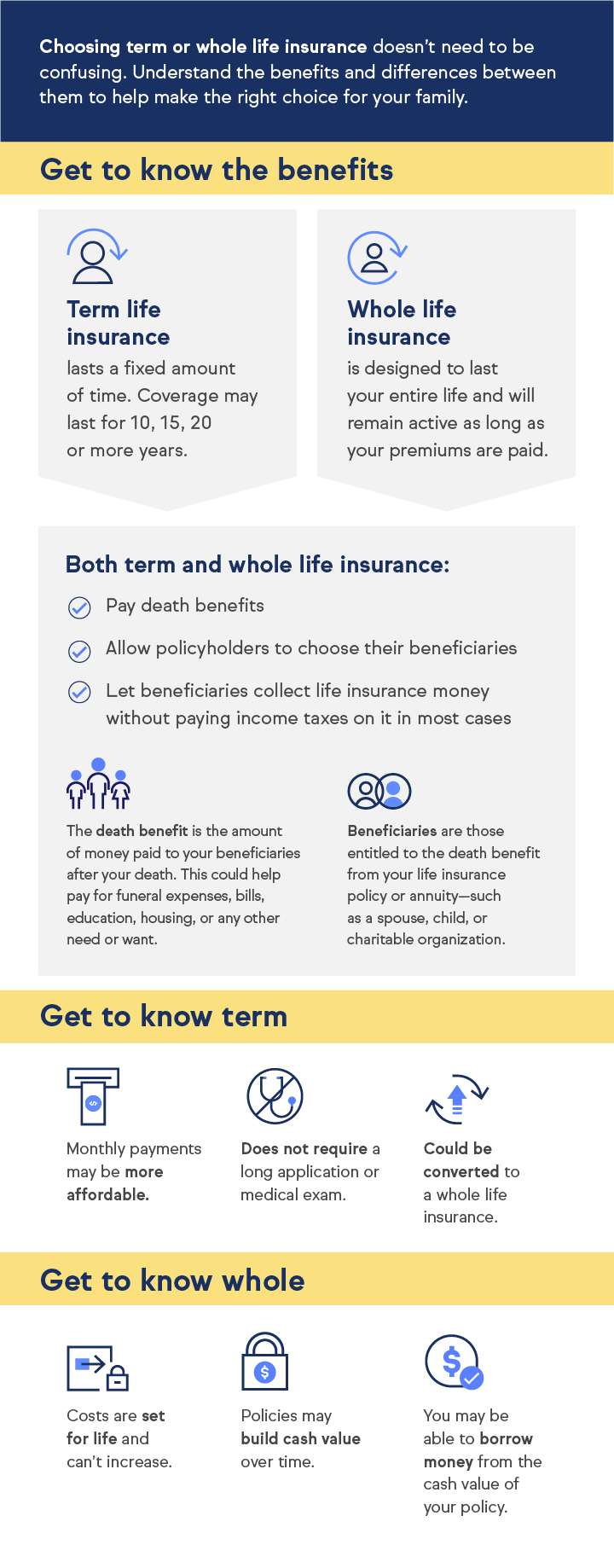

There is no payment if the plan runs out before your fatality or you live beyond the plan term. You might have the ability to restore a term plan at expiry, yet the premiums will be recalculated based upon your age at the time of renewal. Term life insurance policy is usually the the very least costly life insurance policy offered because it offers a death benefit for a restricted time and doesn't have a cash money worth part like irreversible insurance coverage.

At age 50, the costs would increase to $67 a month. Term Life Insurance policy Fees 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for guys and women in superb health and wellness.

Direct Term Life Insurance Definition

Rate of interest prices, the financials of the insurance business, and state policies can likewise influence premiums. When you think about the amount of protection you can obtain for your costs bucks, term life insurance has a tendency to be the least expensive life insurance coverage.

He buys a 10-year, $500,000 term life insurance plan with a premium of $50 per month. If George dies within the 10-year term, the policy will certainly pay George's recipient $500,000.

If George is identified with a terminal disease throughout the first policy term, he probably will not be eligible to restore the policy when it expires. Some plans offer ensured re-insurability (without proof of insurability), yet such attributes come at a higher expense. There are several kinds of term life insurance policy.

Usually, most business supply terms ranging from 10 to three decades, although a few offer 35- and 40-year terms. Level-premium insurance policy (10 year term life insurance meaning) has a set monthly settlement for the life of the policy. A lot of term life insurance policy has a degree costs, and it's the kind we've been referring to in the majority of this write-up.

What Is A 30 Year Term Life Insurance Policy

Term life insurance policy is attractive to young people with youngsters. Moms and dads can get considerable protection for an inexpensive, and if the insured passes away while the plan holds, the household can rely upon the death advantage to change lost revenue. These policies are also well-suited for people with growing households.

Term life policies are ideal for individuals who want considerable coverage at a low expense. People that own whole life insurance coverage pay a lot more in premiums for much less coverage yet have the safety of understanding they are protected for life.

The conversion motorcyclist should permit you to convert to any kind of irreversible policy the insurer uses without constraints - extending term life insurance. The primary features of the biker are keeping the initial wellness score of the term policy upon conversion (even if you later on have health issues or come to be uninsurable) and making a decision when and just how much of the insurance coverage to transform

Of course, overall costs will increase considerably because entire life insurance policy is a lot more pricey than term life insurance coverage. The benefit is the guaranteed authorization without a medical test. Medical problems that establish throughout the term life period can not trigger costs to be increased. Nonetheless, the company might require restricted or complete underwriting if you want to include added cyclists to the new policy, such as a lasting treatment biker.

Whole life insurance coverage comes with considerably greater month-to-month costs. It is suggested to provide protection for as lengthy as you live.

Can I Transfer My Term Life Insurance Policy To Another Company

Insurance policy business set an optimum age restriction for term life insurance coverage plans. The costs also climbs with age, so an individual aged 60 or 70 will pay significantly even more than somebody years more youthful.

Term life is somewhat comparable to cars and truck insurance policy. It's statistically unlikely that you'll need it, and the costs are cash down the tubes if you don't. If the worst occurs, your family will obtain the advantages.

This plan layout is for the client that needs life insurance however wish to have the ability to choose how their cash worth is invested. Variable plans are underwritten by National Life and distributed by Equity Services, Inc., Registered Broker/Dealer Associate of National Life Insurance Coverage Firm, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 honor info, browse through Irreversible life insurance establishes money value that can be obtained. Policy fundings accrue passion and unpaid plan financings and interest will reduce the survivor benefit and money worth of the policy. The quantity of cash money value available will generally rely on the kind of irreversible policy purchased, the quantity of coverage acquired, the length of time the plan has been in pressure and any superior policy financings.

Graded Death Benefit Term Life Insurance

Disclosures This is a general summary of coverage. A complete statement of protection is found only in the policy. For more information on coverage, costs, restrictions, and renewability, or to request protection, contact your neighborhood State Ranch representative. Insurance coverage policies and/or linked bikers and attributes might not be readily available in all states, and policy conditions may vary by state.

The primary distinctions between the various sorts of term life plans on the marketplace relate to the length of the term and the coverage amount they offer.Level term life insurance coverage includes both degree costs and a level survivor benefit, which suggests they stay the exact same throughout the duration of the plan.

, also known as a step-by-step term life insurance coverage plan, is a plan that comes with a fatality benefit that raises over time. Common life insurance coverage term lengths Term life insurance policy is budget friendly.

The major distinctions in between term life and whole life are: The length of your protection: Term life lasts for a set duration of time and then expires. Average regular monthly entire life insurance policy price is computed for non-smokers in a Preferred wellness classification, obtaining an entire life insurance coverage policy paid up at age 100 provided by Policygenius from MassMutual. Aflac supplies numerous long-lasting life insurance coverage policies, consisting of whole life insurance coverage, last cost insurance coverage, and term life insurance policy.

Latest Posts

10 Year Level Term Life Insurance

Credit Life Insurance Is Generally Blank______ Expensive Compared To Equivalent Term Life Insurance.

What Is Extended Term Life Insurance